With-profits investments from Standard Life

With-profits investments are not available to new customers. If you already have one, it's important to understand how it works to make sure you're able to access all its benefits. If you transfer or surrender your policy, for example, you could lose your guarantee. So please take a little time to review this guidance and your policy documents, and make sure you understand how your investment works and what you need to do to protect it.

All our with-profits funds are monitored by our independent With-Profits Committee to make sure they are operated fairly for all policy holders.

With-profits investments - an overview

With-profits are medium to long-term investment options. They may form all or part of a pension fund, a with-profits bond or another savings product. We invest the money you pay us in a mix of assets, like equities, bonds and money market instruments, including cash. We then use the return on those assets to create the payout for your policy.

Compared to some other investment types, with-profits investments are relatively secure. Some offer guaranteed payouts, giving you a safety net against poor market performance. Even without a guarantee, you still have some protection through a process called smoothing, which we'll look at in the next section.

Smoothing out market ups and downs

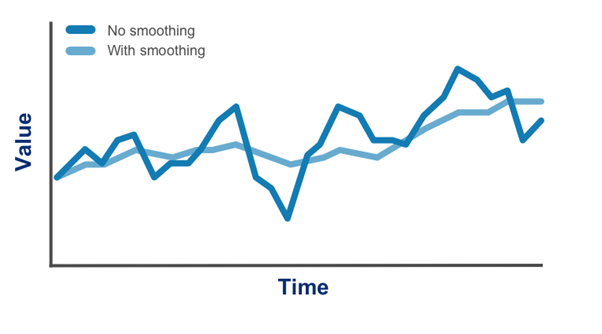

Investment markets can be volatile and there's always the risk you'll lose money. To help protect you from short-term market lows, your with-profits investment has a feature called 'smoothing'. It evens out the market's ups and downs, providing some protection and stability to policy values or, if you have a With-Profits Retirement Annuity, to your annuity instalments.

Smoothing generally means that you benefit over time from market highs, while your policy value doesn't immediately suffer the full effects of the lows. The darker line in the diagram below shows how the payout value of your with-profits investment could fluctuate without smoothing. The lighter line shows how smoothing could affect that value by smoothing down during some times and up at others.

From time to time, depending on market conditions, smoothing may be reduced or switched off completely.

This diagram is for illustrative purposes and doesn't represent actual plan performance. It is only to give you an idea of how smoothing can work.

Guarantees for peace of mind

Not all with-profits investments offer guarantees. There are none, for example, in our Pension With Profits Fund A, Pension With Profits Fund D or Standard Life With Profits Fund. If you're not sure which funds you're invested in, you can find out from your annual statement.

Guarantees are a valuable feature of most with-profits investments. As the name suggests, they offer a guaranteed payout at the end of the investment period. We aim to increase the payout amount over time by adding regular bonuses.

Even if the value of your investment has dropped below the guaranteed amount when the investment period ends, you'll still receive that amount. If the value has increased, we'll add a final bonus to bring your payout up to that amount.

You pay for guarantees through deductions from your with-profits investment – the value of your with-profits investment allows for them, so they don't impact your final payout.

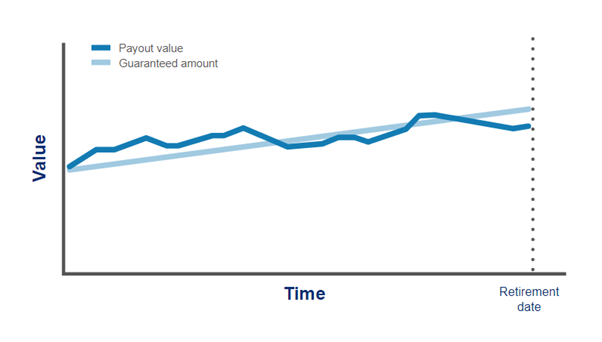

How with-profits guarantees work

The graph below shows you how the value of a with-profits investment can change in different market conditions, demonstrating the benefit of a guarantee.

The darker line shows how your payout value could change over time. The lighter line shows how the guaranteed amount – the minimum we will pay when you meet the guarantee terms – can increase over time.

This graph is for illustrative purposes only and doesn't represent actual plan performance. It is only to give you an idea of how guarantees can work. We have assumed a single payment has been invested in a unitised with-profits plan and that smoothing is applied to the payout value over this period.

Important information: Your guarantee can be a very valuable feature of your with-profits investment, so it's important to understand all the conditions that apply. For example, transferring or surrendering your policy could cost you your guarantee. Please speak to a financial adviser if you're thinking of moving your investments out of your with-profits policy.

Bonuses

This section only applies to with-profits investments that offer a guarantee. It does not apply to our Pension With Profits Fund A, Pension With Profits Fund D or Standard Life With Profits Fund. If you're not sure which funds you're invested in, you can find out from your annual statement. Guarantees for With Profits Pension Annuities work in a different way. You can find out more from our Useful Guides.

Your with-profits investment can benefit from two types of bonus: regular and final.

Regular bonuses

We aim to increase your guaranteed amount over the lifetime of your with-profits investment. For most with-profits investments we do that by adding regular bonuses. Rates for those bonuses are normally set once a year.

It's worth remembering that the regular rate may be set at zero – that would mean no bonus until a new rate is set.

Some with-profits investments, however, offer a guaranteed growth rate that's entirely separate from the bonus rate. Where that's the case, provided the guaranteed growth rate is above 0%, your final payout will continue to increase regardless of where the bonus rate is set.

It's always our aim to provide investment growth over the long term. That means we try to strike a balance between regular and final bonuses.

If we set regular bonuses high, final bonuses might be reduced. That's because we need to invest more cautiously to cover the regular bonus cost. In the long term, cautious investments are likely to mean lower returns. As a result, we set a lower final bonus.

The converse is also true. If we set lower regular bonuses, meaning slower-growing guaranteed amounts, we have more freedom to invest less cautiously. We would anticipate higher risks leading to higher returns over the long term, so we set final bonuses higher.

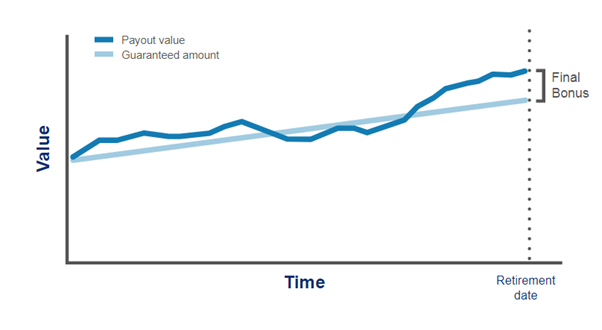

Final bonuses

You may receive a final bonus when your with-profits investment ends. The amount you could get depends on things like:

- The payments you make

- The deductions we make

- Investment returns on the assets in the with-profits fund

- The amount of smoothing we apply

The graph below shows how the guaranteed amount and payout value of a with-profits investment can change over time. The darker line shows how the payout value of a with-profits investment could change over time. The lighter line shows how the guaranteed amount can grow over time – this is the minimum amount that we will pay when the guarantee terms are met.

When the final payout value of your investment is higher than the guaranteed amount, you receive a final bonus to bring the payout up to that amount.

This graph is based on an individual pension and does not show the actual performance of any Standard Life with-profits investment. It is only to give you an idea of how final bonuses work. We have assumed a single payment has been invested in a unitised with-profits plan and that smoothing is applied to the payout value over this period.

Useful links

-

With-profits committee

Our With-profits Committee provides independent input to protect your interests. This page tells you how.

-

With-profits documents

Bonus update briefings, quarterly and annual reports and information about operating principles of our with-profits funds.

-

With-profits useful guides

Information about Standard Life with-profits funds, including policy and guarantee information, fund descriptions and principles and practice of financial management.